Understanding Your Car Insurance Coverage After A Car Accident

Understanding Your Car Insurance Coverage After A Car Accident

Car insurance is required by law in almost every state in the country. The majority of states have passed laws controlling how much and what type of coverages are required (state minimums). As such, it should come as no surprise that every state has a different scheme of regulating insurance. Luckily, Arizona is one of the states with the highest minimum insurance requirements. The amount that every driver must have is $25,000. This is the minimum coverage required by Arizona law.

If you were injured in a car accident and are having a difficult time understanding your insurance policy, you should read below. This article will help distinguish the most important aspects of your car insurance policy.

What Is the Declaration Page of a Car Insurance Policy?

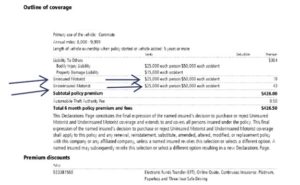

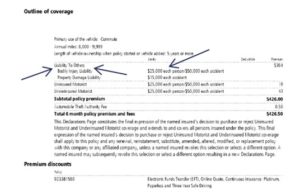

Typically, the controlling documents for your car insurance policy will be your insurance policy “declaration page” and your insurance policy “booklet.” The declaration page is usually a one-page document that indicates what type of coverage you have purchased and how much of it is available to you. It contains the personal information of the insured and any endorsements on the insured’s vehicles. In addition, the declaration page will also outline your premium obligation and any deductibles or discounts associated with your policy. The declaration page is essentially a snapshot of your insurance coverage.

What is the Policy Booklet of a Car Insurance Policy and Why Is it Important?

Your insurance policy booklet will be much larger than your declaration page. It is usually 20-50 pages in length. It will contain all the specifics regarding your car insurance policy. It is important because it contains all the “fine print” setting forth what is covered and any exclusions.

As the declaration page outlines how much your insurance company is obligated to pay, your policy booklet outlines when they are required to pay. Among other things, your insurance policy booklet defines relevant terminology and contains exclusions applicable to your policy. You should review your policy exclusions to make sure that your needs are covered.

As the declaration page outlines how much your insurance company is obligated to pay, your policy booklet outlines when they are required to pay.

Exclusions vary depending on the insurance policy. It is very important to read your policy booklet to understand which exclusions apply. Common exclusions include scenarios involving motorcycles, family members, work vehicles, ride-share services, driving for pay and driving in other countries. Fortunately, coverage issues are not the norm. Unless you have reason to believe there may be an issue in your policy booklet, you should really only need to rely on your declaration page. The section below will explain how to read and interpret your insurance declaration page.

What is Liability Coverage and Is it Required?

Liability coverage, or bodily injury coverage, is insurance coverage purchased to compensate another person for injuries or damages that arise out of an accident. If you have been injured as the result of another driver’s negligence then you should be able to access that driver’s liability coverage. Generally, your liability coverage will only be used when you are at fault for causing injury to another person. Unlike, the other coverages listed below liability coverage is mandatory in Arizona.

This type of coverage can pay for things such as medical expenses, lost wages, and pain and suffering. In Arizona, the minimum amount of liability insurance you must carry is $25,000/$50,000. The two numbers reflect situations where one person is injured and when multiple parties are injured. Per the State minimum requirements, insurance policies must provide coverage of at least $25,000 per person injured and $50,000 per incident or accident (more than one person involved).

This type of coverage can pay for things such as medical expenses, lost wages, and pain and suffering. In Arizona, the minimum amount of liability insurance you must carry is $25,000/$50,000. The two numbers reflect situations where one person is injured and when multiple parties are injured. Per the State minimum requirements, insurance policies must provide coverage of at least $25,000 per person injured and $50,000 per incident or accident (more than one person involved).

This means that if one person is injured, the most they can recover is $25,000. If multiple people are injured in a crash, the most they could recover combined is $50,000. For example, if four people were injured in a single crash, they would have to divide the $50,000 in coverage.

However, it is highly recommended that you purchase more than just the state minimum if you are able to. As $25,000 is enough to cover minor injuries such as strains and sprains, it is likely not enough to cover more serious injuries such as broken bones, torn ligaments or intracranial trauma. If you do not have enough insurance coverage to cover injuries you have caused, you may be exposing yourself to personal liability. This could result in a court ordering you to pay for damages you have caused.

What is Underinsured / Uninsured Motorist Coverage and How Does it Work?

Underinsured Motorist Coverage is insurance purchased to compensate you for injuries you have sustained when the other driver does not have enough liability coverage. Uninsured Motorist Coverage is insurance purchased to compensate you for injuries you have sustained when the other driver does not have any liability insurance. These insurance coverages are optional and not mandatory.

The reason these coverages are so important is because they guarantee that you will be compensated for any injuries sustained no matter what insurance coverage the at-fault party has. If you are hurt as a result of another driver’s negligence and you do not have underinsured/uninsured motorist coverage, you are limited to whatever the at-fault driver’s liability coverage is.

Depending on where the collision occurred, your chances of receiving compensation may be low. According to the Insurance Information Institute, roughly 12% of drivers in Arizona are uninsured. If you are unlucky enough to find yourself in a collision with one of these drivers, your uninsured motorist coverage could be your only source of recovery. Likewise, if you are hurt by a driver who simply does not have enough liability coverage, you would want an underinsured motorist policy to help cover any damages exceeding the at-fault party’s insurance coverage.

What is Medical Payments Coverage and Do I Need it?

Medical Payment Coverage is a nice feature to have on your insurance policy, but it is not completely necessary. If it is not listed on your Declaration page than you likely have not purchased it. However, you should always contact your insurance company to confirm this.

This type of coverage is referred to as “no-fault” coverage and can be used even if you were at fault for causing your own injuries. MedPay is an optional form of coverage that can only be used by the person who purchased it or by someone in that person’s vehicle. MedPay is unique from other forms of insurance coverage as it can only be used to pay medical expenses resulting from an accident.

In fact, most insurance companies require that you submit medical bills in order to receive MedPay benefits. Damages such as pain, suffering, or lost wages cannot be submitted for MedPay benefits. Most MedPay policies will pay out these benefits even if your medical bills were paid by another source such as your health insurance. In these situations, it is essentially free money that you get to keep unless you are required to pay it back as discussed below.

You May Have To repay Your MedPay Benefits

Another feature about MedPay is that most insurance companies have carved out a right to be reimbursed once they make payments. If another driver is at-fault for causing your injuries and you received MedPay benefits as a result, your insurance company will likely have a right to be reimbursed for those payments. However, in Arizona the right to be reimbursed only begins after your insurance company has paid $5,000. This means that the first $5,000 of MedPay benefits can be kept by the injured party without having to pay back the insurance company. For this reason, it is very common to see MedPay policy limits of $5,000.

Contact Scottsdale Injury Lawyers if You Had a Car Accident and Have an Insurance Question

As your Declaration page is a great starting point, you should always consult an experienced personal injury attorney with any insurance related issues. As mentioned, most insurance coverage issues arise from the language listed in the insurance policy booklet, rather than the declaration page. The skilled attorneys at Scottsdale Injury Lawyers have the knowledge and experience to examine your situation. Do not discount your case without talking to us first. A consultation is free. Our attorneys can perform the consultation by phone. Contact us today.

About the author: The content on this page was provided by Scottsdale personal injury attorney and civil rights lawyer Tony Piccuta. Piccuta graduated with honors from Indiana University-Maurer School of Law in Bloomington, Indiana (Previously Ranked Top 35 US News & World Report). Piccuta took and passed the State bars of Arizona, California, Illinois and Nevada (all on the first try). He actively practices throughout Arizona and California. He is a trial attorney that regularly handles serious personal injury cases and civil rights lawsuits. He has obtained six and seven figure verdicts in both state and federal court. He has been recognized by Super Lawyers for six years straight. He is a member of the Arizona Association of Justice, Maricopa County Bar Association, Scottsdale Bar Association, American Association for Justice, National Police Accountability Project and Consumer Attorneys of California, among other organizations.

Disclaimer: The information on this web site is for informational purposes only and does not constitute legal advice. The information on this page is attorney advertising. Reading and relying upon the content on this page does not create an attorney-client relationship. If you are seeking legal advice, you should contact our law firm for a free consultation and to discuss your specific case and issues.

References: [1] https://www.iii.org/fact-statistic/facts-statistics-uninsured-motorists