Medical Payments Insurance After a Car Accident-What You Need to Know

Medical Payments Insurance After a Car Accident-What You Need to Know

Medical Payments insurance is a type of additional insurance coverage that you can obtain under your car or automobile insurance policy. The coverage is usually referred to as MedPay or Med Pay. The benefits from this coverage can be paid directly to you for medical expenses incurred as a result of an accident.

Is Med Pay or Medical Payments Coverage Mandatory in Arizona?

Med Pay or Medical Payments coverage is not a mandatory coverage in Arizona. It is an optional coverage that you can decide to purchase when you obtain auto insurance. The coverage can be obtained for different amounts. The higher the coverage you select the more expensive your premium will be.

The personal injury attorneys at our firm typically see Med Pay coverage limits in the amounts of $1,000, $5,000 and $10,000. However, we have seen Med Pay coverage limits as high as $100,000. This is extremely rare, but we have encountered it.

Is Med Pay or Medical Payments Coverage the Same Under All Insurance Policies?

Med Pay insurance differs from policy to policy. As such, you need to review your auto insurance policy to determine how much coverage you have and when it applies. Some insurance policies only allow collection of Medical Payments benefits under specific conditions. Other insurance policies allow individuals to receive Med Pay benefits in more situations.

Some insurance policies will allow individuals to receive Medical Payments benefits even if the injuries were not sustained from driving one of the covered vehicles. For example, many insurance policies will allow an individual to recover Med Pay benefits if the individual was a pedestrian and hit by a car. Others may allow an individual to recover these benefits if they were injured while riding a bicycle or public transportation. If you were in an accident and have Medical Payments coverage, it is important to consult with an attorney and have the attorney analyze your policy for coverage.

What does Med Pay Insurance Cover?

Medical Payments coverage allows you to recover for the reasonable medical expenses incurred for injuries treated as a result of a covered accident. This can include amounts owed for medical expenses, amounts paid for medical expenses, co-pays and out of pocket deductibles. Some policies allow for the payment of these benefits even if you have health insurance that paid the costs of the medical expenses. As discussed in the next section, other policies do not allow this.

What Is an Excess or Secondary Medical Payments Policy?

Some Medical Payments policies are written to only provide benefits after all other sources of insurance have been used. These types of policies are referred to as excess or secondary Medical Payments policies. The reason they are called excess is because they only pay the excess that may be owed after applying other health insurance benefits. The reason they are called secondary is because they are considered a secondary source of payment after another insurance is exhausted.

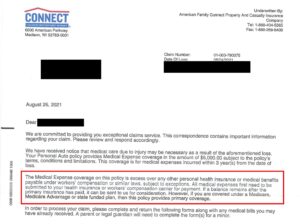

Our car accident attorneys encounter excess Medical Payments policies frequently written by American Family Connect insurance. This insurance is sold through Costco. Below is a Med Pay letter from American Family in a case our attorneys handled.

The language from the letter specifically states that the “Medical Expense coverage on this policy is excess over any other personal health insurance or medical benefits payable….All medical expenses first need to be submitted to your health insurance…if a balance remains after the primary insurance has paid, it can be sent to us for consideration.” This is a classic excess Medical Payments policy. However, these policies are the exception and most do not require this.

Can You Collect Medical Payments Benefits Even if Your Health Insurance Has Paid Those Charges?

Most of the time, you can collect Med Pay benefits even if your health insurance has paid those same charges. In other words, most Medical Payments policies are not excess policies. They also do not refuse to pay benefits if your medical bills have already been paid by another source.

In other words, even if your health insurance has paid your medical bills, you can still collect your Med Pay benefits by submitting your medical bills. Most Medical Payments policies will pay benefits regardless of whether or not a balance is owed. All you need to do is present the charged amount of your bills and show the treatment was related to the car accident in order to collect these benefits.

Will the Insurance Company Pay Every Medical Bill Submitted Under the Medical Payments Coverage?

Insurance companies will only pay Medical Payments benefits for treatment received as a result of the car accident. In addition, insurance companies are only obligated to pay the reasonable amount of the services provided. As a result, you need to show that the medical treatment was necessitated by the crash. You will also have to show that the medical charges are the same as those customarily charged for the same services.

Some medical services may be more difficult to relate to the car accident. For example, an insurance company may deny payment of Medical Payments benefits if the treatment is too far removed from the car accident. Insurance companies may also refuse to pay for non-traditional medical treatment. For example, an insurance company may be unwilling to pay for acupuncture or massages if they do not believe that treatment is reasonable or indicated.

Finally, insurance companies will not pay Med Pay benefits if they find the charges are inflated or excessive. The insurance companies have databases that tell them what the customary and reasonable charges for a service are. For example, an insurance company will refuse to pay Medical Payments benefits for an MRI that costs $10,000 if their database shows that it typically costs $2,000. In that situation, they will only pay $2,000 which is the amount they conclude is reasonable.

Who Can Receive Med Pay Benefits?

Who can receive Medical Payments benefits depends on the insurance policy language. Typically, this includes any listed individual on the policy or any passengers in a covered vehicle. Also, any individuals in the vehicle may recover the benefits regardless of who was at fault for causing the car accident.

Our Law Firm Does Not Charge Any Fees on Med Pay Benefits Collected

Unlike other law firms, Scottsdale Injury Lawyers does not charge any fees for handling the Medical Payments portion of a case. We submit all Medical Payments claims and see that those benefits are collected. This is at no charge to the client.

We can make sure that the Medical Payments benefits are paid and collected in a way where the client receives the biggest financial benefit.

This means that our clients receive every cent of the Medical Payments coverage and benefits paid. This can add up to a lot of money and help a client recover significant compensation for his or her car accident case. More importantly, we can make sure that the Medical Payments benefits are paid and collected in a way where the client receives the biggest financial benefit. This is described in greater detail in the section below.

Our Experienced Injury Attorneys Will Make Sure Your Medical Payments Benefits Are Not Wasted

It is important to have an experienced injury attorney who knows how best to manage the collection of Medical Payments benefits. This starts at the beginning of a case. Our attorneys will provide you with the information you need to make sure you receive the Medical Payments benefits and that those benefits are not paid to a medical provider who does not deserve it.

Often times, medical providers will make claims to the Med Pay benefits. If they do, they can receive the full amount of those benefits and exhaust them quickly. This leaves the client with no money from the Medical Payments policy.

The difference in the handling and collection of Medical Payments benefits could be the difference between the client receiving tens of thousands of dollars and zero.

The difference in the handling and collection of Medical Payments benefits could be the difference between the client receiving tens of thousands of dollars and zero. It is important to consult with an experienced Arizona personal injury attorney if you have Medical Payments coverage and are in a car accident. Contact our law firm today to speak to an experienced Scottsdale car accident attorney.

Do the Medical Payments Benefits Need to Be Paid Back if There is a Settlement With the At-Fault Party?

Whether or not Medical Payments benefits need to be paid back from a settlement depends on a few things. First, insurance companies who pay Medical Payments benefits are not allowed to seek repayment of the first $5,000 paid under any circumstances. This practice is prohibited by Arizona law.

This is set forth in Arizona Revised Statutes § 20-259.1(J). This section sets forth the following:

“Any automobile liability or motor vehicle liability insurer that makes a payment under the medical payments coverage of a motor vehicle insurance policy to or on behalf of any insured for an injury that arises out of an accident that occurs after December 31, 1998 may have a lien against any amount in excess of $5,000 that is paid to or on behalf of that insured under the medical payments coverage of the policy for that accident.”

What this section also provides is that the insurance companies can claim repayment for any Medical Payments benefits paid over $5,000 if there is a settlement with the at-fault party. However, insurance companies are required by law to “compromise the lien in a fair and equitable manner.” Our skilled car accident attorneys understand the law in this area and have strategies we employ to make sure the insurance companies compromise their repayment rights. Often times, we can negotiate complete waivers of these repayment amounts or significant reductions. When we do, the money goes directly into the pockets of our clients.

Contact a Scottsdale Car Accident Attorney to Help You With Your Case

If you or a loved one was injured in a car accident, contact our law firm today. Our car accident attorneys have handled hundreds of car accident cases. We understand the insurance coverages and what someone is entitled to recover. More importantly, we know the law that controls what insurance companies are allowed to do and what they are prohibited from doing.

Do not take on an insurance company by yourself or you will be taken advantage of. Contact us today for representation and we will maximize the amount of compensation you receive. A consultation is free and we only earn a fee if we recover for you.

About the author: The content on this page was provided by Scottsdale personal injury attorney and civil rights lawyer Tony Piccuta. Piccuta graduated with honors from Indiana University-Maurer School of Law in Bloomington, Indiana (Previously Ranked Top 35 US News & World Report). Piccuta took and passed the State bars of Arizona, California, Illinois and Nevada (all on the first try). He actively practices throughout Arizona and California. He is a trial attorney that regularly handles serious personal injury cases and civil rights lawsuits. He has obtained six and seven figure verdicts in both state and federal court. He has been recognized by Super Lawyers for six years straight. He is a member of the Arizona Association of Justice, Maricopa County Bar Association, Scottsdale Bar Association, American Association for Justice, National Police Accountability Project and Consumer Attorneys of California, among other organizations.

Disclaimer: The information on this web site is for informational purposes only and does not constitute legal advice. The information on this page is attorney advertising. Reading and relying upon the content on this page does not create an attorney-client relationship. If you are seeking legal advice, you should contact our law firm for a free consultation and to discuss your specific case and issues.

References: